Why Buy Solar on Finance?

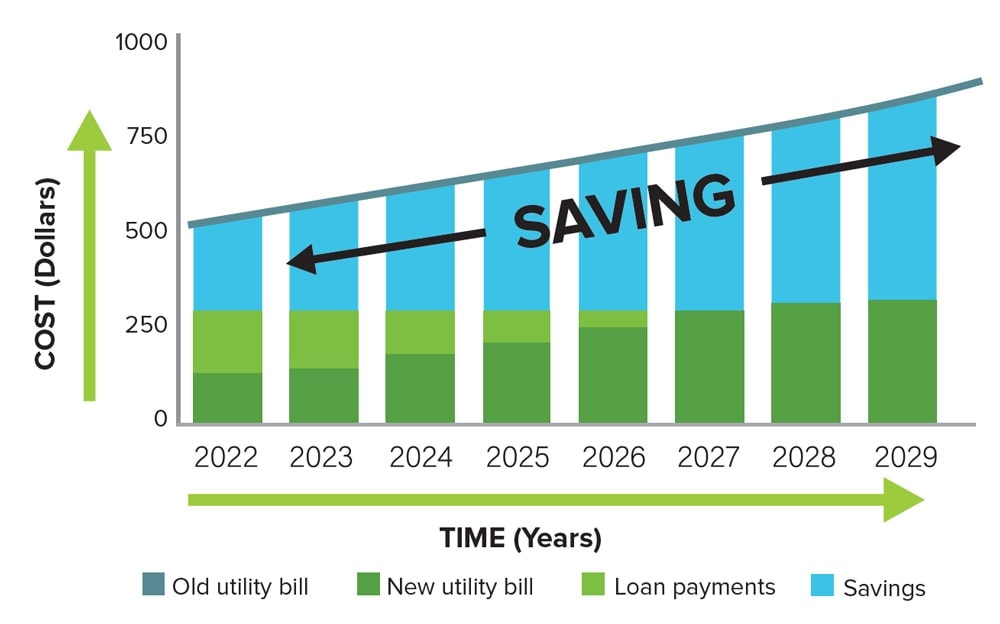

Lower Energy Bills

Installing a solar panel system can greatly reduce electricity bills by generating free power during daylight hours. You can save thousands on energy a year depending on how much electricity you use.

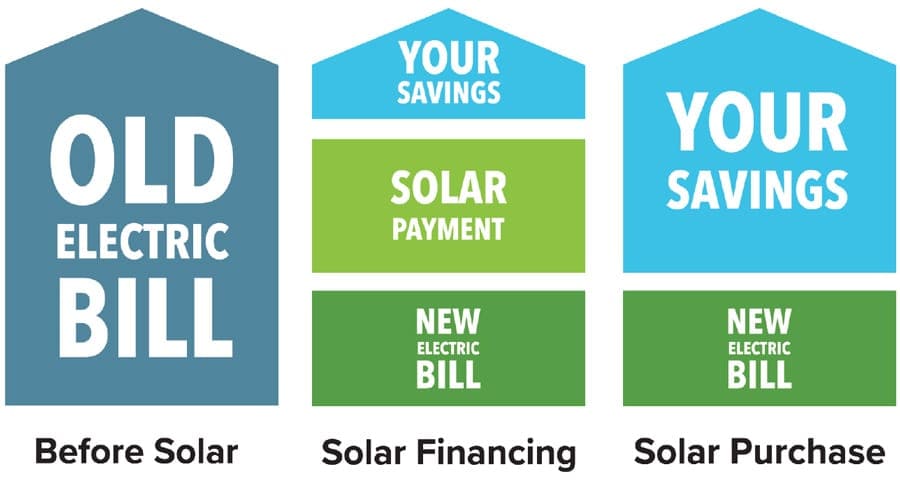

Day 1 Cash Flow

Solar finance eliminates the wait for solar installation and allows for immediate installation of solar panels. As a result of your solar panels reducing your energy bill, your savings should be higher than your finance repayments. This means an affordable financing option is available with no additional or upfront expenses for a system.

Solar Incentives

STCs (Small-scale Technology Certificates) are a financial incentive part of the Government’s Renewable Energy Target scheme. They reduce upfront installation costs of small-scale renewable energy systems.

Brighte Solar Financing

Geraldton Solar Force has teamed up with Brighte to offer you two great residential finance deals.

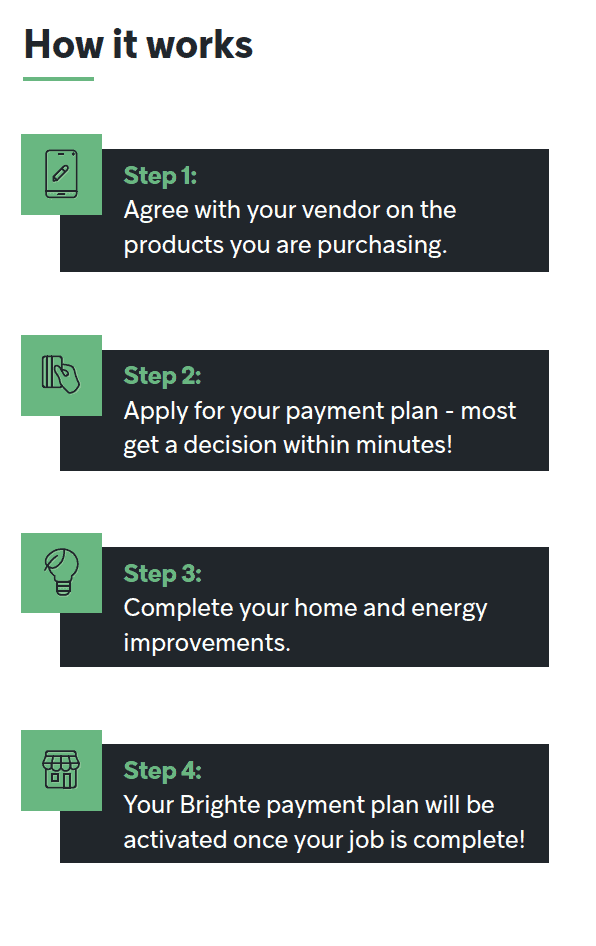

0% Interest Payment Plan

- 0% Interest

- $1 Weekly Account Keeping Fee

- Approved applicants only

- $1,000 minimum finance amount

A late payment fee of $4.99 may be charged if you miss a repayment. Late fees are capped at $49.90 per calendar year.

Credit provided by Brighte Capital Pty Limited ABN 74 609 165 906.

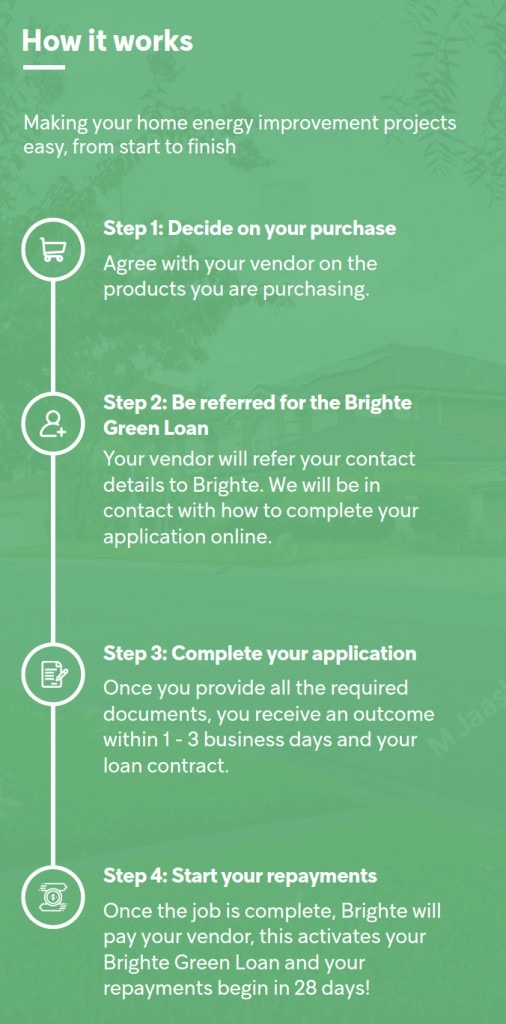

Brighte Green Loan

- 0% Interest

- $1 Weekly Account Keeping Fee

- Approved applicants only

- $1,000 minimum finance amount

A late payment fee of $4.99 may be charged if you miss a repayment. Late fees are capped at $49.90 per calendar year.

Credit provided by Brighte Capital Pty Limited ABN 74 609 165 906.

Eligibility for a Brighte Payment Plan or Loan

To be eligible for this plan, you must meet this criteria:

- Over 18 years old

- Australian resident or citizen

- Own or in the process of purchasing your home

- Have a clear credit file

- Employed for more than 25 hours per week, a self-funded retiree; or receiving the Government Aged Pension/Veteran’s Pension

*Credit provided by Brighte Capital Pty Ltd (ABN 74 609 165 906). Approved applicants only. Min finance amount of $1,000. Late payment fee of $4.99 may be charged if you miss a repayment.

**Information and interest rates are current as of 8 June 2020 and are subject to change. Late payment fee of $4.99 may be charged by Brighte if you miss a repayment. All applications for credit are subject to Brighte’s credit approval. Fees, terms and conditions apply.

^Comparison rate calculated on an unsecured loan amount of $30,000 over a term of 5 years based on fortnightly repayments

WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.